巨大落差:美国房价的回落

爱思英语编者按:美国次贷危机前,美国房地产从业人员一度人均创造的GDP高达74万美元,而同期人均GDP仅为4万美元,美国金融和房地产业的总利润占美国企业总利润的40%以上。然而,2006年末至2007年,泡沫崩溃,借款人无力偿还贷款时,银行紧急抛售房屋,却发现售价已不能弥补当时的贷款加利息。大量坏账出现,多米诺骨牌效应产生,次贷危机应运而生。

今年美国一家大市场的金融机构Macro Markets对超过100个经济学家进行问卷调查,结果显示,这百位经济学家对2012年房价的平均预测上涨率为0.25%。同时,这百位经济学家预计2015年,房价涨幅将达到1.1%,美国房地产市场将进入一个缓慢的上升过程。房利美则预测在2012年房屋的总成交量将达到480万套。另外,美国找房网Home Finder对美国民众的调查显示,22%的美国人认为房价在2012年会上涨,53%的美国人则认为房价将维持原价,22%的美国人预期房价将仍然下跌。在受访的美国人中,68%的人表示2012年将是买房好时机,33%的人预测贷款利率在2012年将有所上扬。从数据中可以看出,大多数美国认为2012年将成为房地产业的新拐点。

Buttonwood

梧桐树

The great divide

巨大差异

Why American house prices have corrected more than those in Europe?

为何美国房价的回落幅度比欧洲的更大?

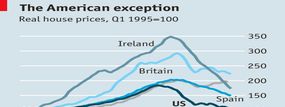

ANDREW MELLON, Herbert Hoover’s treasury secretary, advised the president to “liquidate real estate” as part of a plan to “purge the rottenness out of the system”. Eighty years later, America has pretty much followed his advice. House prices have lost nearly all the real gains they notched up in the bubble period (see chart). That makes for a marked contrast with Europe, where prices may be off their peaks but have not lost all their real gains. Why the difference?

赫伯特•胡佛(Herbert Hoover)的财政部长安德里•默龙(ANDREW MELLON)曾向总统建议把“清算房地产”作为“涤荡经济中的腐败”计划的一部分。80年后,美国基本是照着他的建议做的。不计通胀,美国房价已几乎跌至泡沫时期前的水平(见图表)。这与欧洲形成了鲜明对比。欧洲目前的房价与房价最高时相比可能有所回落,但和泡沫时期前相比还是有实际增值的。造成这种差别的原因何在?

Many people think that owning a house is a certain moneymaker, but this is not the historical experience. In his recent book “Safe as Houses? A Historical Analysis of Property Prices”, Neil Monnery presents data from an array of nations going back (in some cases) several centuries. What he discovers is that real house prices have generally been flat over time, or have increased by at most 1% a year. Rather like gold, then, house prices have been a good store of value rather than an automatic route to riches.

很多人想当然地认为拥有一处房产就能赚大钱,但根据历史经验,事实并非如此。在Neil Monnery的新书《安全如房产?房价的历史分析》中,他列出了一系列国家的历史房价数据(其中一些是几百年来的数据)。他发现一直以来实际房价总体上没什么变化,年增长率最高不过1%。所以房产如同黄金,与其说是一种必然能致富的手段,不如说是一种保值的资产。

The exception is the period of the past 15 years or so, when real house prices took off in a few countries. But not everywhere. In Germany and Switzerland the trend has been flat-to-lower. In Japan there has been a decline which has pretty much wiped out the rise in house prices that occurred between 1970 and 1990. So there are really three types of market to explain: America and Japan, where real prices rose sharply then corrected; those where they rose sharply but have yet to lose all their gains; and those where the markets have been flat in real terms.

而过去大约15年这段时期却是例外,那时一些国家的房价暴涨,但并非各国都如此。在德国与瑞士,房价趋平,甚至有所下降。在日本,房价下跌的幅度几乎大于二十世纪70至90年代之间的上涨幅度。所以,现在实际上要对三种类型的房地产市场进行解释:第一种是美国与日本的,其实际房价在急剧上涨后又回落了;第二种,房价暴涨但实际仍有增值的市场;第三种,扣除物价因素后房价稳定的市场。

It is hard to find an explanation for price movements that applies across markets. Some cite low real interest rates as the main reason that prices have held up in Europe. But real rates have fallen sharply in America as well. For homebuyers, the best measure of the real rate is the gap between the average mortgage rate and annual wage growth. In America this is close to its lowest level in 24 years but the housing market is still flat as a chapati. Indeed, if you divide that period into three, house prices rose faster when rates were high than when they were low. In Britain, real house prices fell by a third between 1973 and 1977, even when real interest rates were sharply negative.

很难用一个原因来解释以上三种房地产市场中的房价变动现象。有人提出实际利率太低是欧洲房价高企的主要原因,不过美国的实际利率同样也大幅下跌。对于购房者,衡量实际利率的最佳尺度就是平均按揭利率与年薪增长率之差。在美国,这个值接近24年来的最低水平,但其房地产市场仍然像恰巴提(印度的一种面包,译者注)一样平抑。实际上,若将那个时期分成三段,就会发现房价在利率高时的增长速度比利率低更快。1973年至1977年间,英国的实际利率明显为负,但即便如此,当时的英国房价仍下跌了三分之一。

Just as the best way to view equities is as the discounted value of future cashflows, the best way to view property is as the discounted value of future rents. The temptation is to think that, as real rates fall, the present value of housing must rise. But why are real rates low? They are being held down by central banks which are worried about the economic outlook. If the central banks are right, then rents will surely grow more slowly in future. A paper* by Christian Hott and Terhi Jokipii calculates that on this basis, British, Irish and Spanish house prices are still well above their “fundamental” value, while those in America are about right.

衡量股票价值的最佳方法是看未来现金流的折现价,同样,衡量房产价值的最佳方法是看未来房租的折现价。人们很容易会这样想:随着实际利率的下降,房产的现值一定会上升。但为什么当前的实际利率那么低?压低利率的其实是那些担忧经济前景的央行。若各央行的想法正确,那么将来的房租肯定会涨得更慢。据此,Christian Hott和Terhi Jokipii所写的一篇论文估计,目前英国、爱尔兰及西班牙的房价仍远高于其“基本面”价值,美国的房价反而大致合理。

Explore and compare global housing data over time with our interactive house-price tool

点击互动房价工具,查看并比较全球房价数据

Another potential explanation for America’s housing collapse relates to supply. Developers went on a building spree in places like Florida and California, and the result is a glut of empty condominiums. In contrast, Britain’s strict planning laws mean that too few houses have been built to satisfy demand. But overbuilding in Ireland or Spain reached chronic levels, too, and yet their house prices have not corrected to the same extent as those across the Atlantic.

导致美国房价下跌的另一个原因可能是供应方面的问题。开发商们在佛罗里达州和加利福尼亚州这些地方大肆建房,以致于出现了大批闲置的公寓。英国则相反,由于规划法很严格,故所建房屋太少,无法满足需求。但过度建房在爱尔兰和西班牙也是长期存在的问题,只是这两个国家房价的跌幅却不及大西洋彼岸的国家。

What about demand? Houses behave more like a financial asset than a consumer good: as prices rise, demand seems to increase. In addition, there has been a trend towards smaller households (thanks to divorce, greater longevity and so on). But high house prices and tighter lending standards may have brought that process to a halt. Young people are forced to live with their parents or flat-share with contemporaries. These trends are pretty widespread, and it is hard to use them to explain national differences.

那需求方面呢?房产与其说是消费品,还不如说是一种金融资产:随着其价格上涨,需求似乎也在增长。此外,(由于离婚、人均寿命延长等原因)如今的家庭呈小型化的趋势。不过高房价和更严格的贷款标准可能会阻止这一趋势继续发展。现在的年轻人不得不与父母同住或与朋友合租。以上这些趋势十分普遍,很难用来解释各国房价差异。

So perhaps the difference is institutional. American banks had poorer lending standards and have been quicker to foreclose on properties; borrowers have been readier to walk away from their homes. In European countries, owners have been able to sit tight in the hope that prices will recover. European markets are certainly a lot less liquid. Irish transaction volumes dropped by 83% from their peak and Spanish ones by 64%, but American deals fell by just 46%. Europe is going in the same direction as America. It is just getting there more slowly.

所以,各国的房价差异可能源于体制问题。过去,美国的银行贷款标准更宽松,在赎回抵押房产赎方面动作更快;借款者更愿意放弃他们现有的房产了。而在欧洲国家,业主们却能够安坐家中,期待着房价回升。欧洲市场的资产折现力当然远低于美国。爱尔兰的房产成交量比峰值时下跌了83%,西班牙则下跌了64%,但美国仅下跌了46%。其实欧洲的房价走势和美国一样,只是步调比美国慢罢了。