风投公司投资模仿者 VC clone home

爱思英语编者按:风险投资公司,是专门风险基金(或风险资本),把所掌管的资金有效地投入富有盈利潜力的高科技企业,并通过后者的上市或被并购而获取资本报酬的企业。风险资本家将资金投资于新的企业,帮助管理队伍将公司发展到可以“上市”的程度,即将股份出售给投资公众。一旦达到这一目标,典型的风险投资公司将售出其在公司的权益,转向下一个新的企业。

导读:如今,对将既有商业模式运用至新兴市场的新兴企业进行投资的做法在风投行业中日益常见了。这个被称为“热带化”的概念出现已有一段时间,去年,新兴市场的风险投资交易额达34亿美元。这股进军新兴市场的力量势头正劲是因为在传统市场中风投遇到了一些问题,如公司过多及投资者压力增大。在新兴市场的风投活动中,大多数投资针对的是模仿别人商业模式的新兴企业,因为这样能降低风险。而且模仿者还有地域优势,模仿商业模式的方法也各不相同。很快,新兴市场就会出现大量在全球范围内适用的创新商业模式。但在那之前,热带化定会成为一个越来越普遍的策略。

Venture capital in emerging markets

新兴市场的风险投资

VC clone home

风投公司投资模仿者

Making money by bringing old ideas to new markets

将老点子运用至新市场来赚钱

SOME venture capitalists call it “geo-arbitrage”; others know it as “tropicalisation”. The term refers to the practice of backing start-ups that take an established business model and adapt it to an emerging market. Whatever you call it, it is becoming a bigger part of the venture-capital industry as competition at home forces Silicon Valley investors to look farther afield.

一些风险投资者称之为“地缘套利”;另一些则称之为“热带化”。这个术语是指:对将既有商业模式运用至新兴市场的新兴企业进行投资。不论人们称之为何物,由于国内的竞争迫使硅谷投资者将目光放得更远,这种做法在风投行业中越来越常见了。

Julio Vasconcellos, one of the founders of Peixe Urbano, a Brazilian site offering users discounted deals, is thrilled by the “huge flood” of American investors he has noticed coming to Brazil, for instance. No wonder. Some of them, including Benchmark Capital and General Atlantic, have invested in his own company alongside Brazilian venture capitalists. The financiers have reason to be upbeat, too. Peixe Urbano is a clone of Groupon, an American start-up that went public last year; its business model is one they know can take off.

例如,巴西折扣购物网Peixe Urbano的其中一位创始人胡里奥•瓦斯康塞洛斯(Julio Vasconcellos)发现有大量美国投资者“涌入”巴西,为此而感到兴奋。这完全不足为奇。在这些美国投资者中,包括基准资本公司(Benchmark Capital)和泛大西洋投资公司(General Atlantic)在内的一些也和巴西风投者一样投资了他的公司。这些投资者持乐观态度也是有原因的。因为Peixe Urbano复制了团购网(Groupon)的经营模式。团购网是一家去年上市的美国新兴企业;投资者相信其经营模式能够让Peixe Urbano快速发展。

The idea of tropicalisation has been around for a while. It has already been lucrative for venture capitalists in India and China. Take Baidu, a Chinese interpretation of Google, which made early venture investors a killing; or Alibaba.com, a Chinese version of eBay, an online-auction site. Now venture capitalists are looking at other markets, including Brazil, Indonesia, Russia, South Africa and Turkey. Last year $3.4 billion of venture-capital deals were done in emerging markets, more than double the amount in 2008.

热带化这概念诞生已有一段时间了。这已经让风险投资者在印度和中国获利颇丰。看看中国的GOOGLE——百度(让早期投资者大赚一笔)或中国的EBAY——阿里巴巴拍卖网就知道了。如今风险投资者正着眼于包括巴西、印度尼西亚、俄罗斯、南非和土耳其在内的其他市场。去年,新兴市场的风险投资交易额达34亿美元,比2008年高出一倍多。

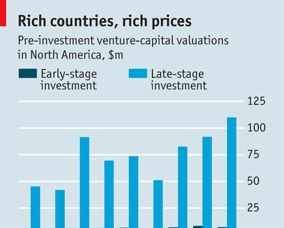

This push into emerging markets has gained momentum because venture capital is experiencing problems in its traditional markets. Silicon Valley was once so inward-looking that venture capitalists used to say they would not back a start-up unless they could cycle to its office. But valuations in North America have risen for both early-stage and later-stage investments (see chart), making it much harder to make great returns.

这股进军新兴市场的力量势头正劲是因为在传统市场中风投遇到了一些问题。硅谷一度十分封闭,以至于那时的风投者常说他们不会投资新兴企业,除非该企业在骑自行车就能到达的范围之内。但在北美洲,前期投资和后期投资的估值都有所上升(见图表),所以赚取巨额利润变得更难了。

That is partly because there are too many firms; 369 of them are currently in the market trying to raise $50 billion, according to Preqin, a research firm. There is a lot less competition in emerging markets. The pressure from investors is also rising. A damning new report by the Kauffman Foundation, an outfit which promotes entrepreneurship, analysed its venture-capital portfolio and concluded that 62 out of 100 funds failed to exceed the returns offered by the public market.

出现这种情况,部分原因是传统市场里公司过多;调查公司Preqin称,目前传统市场中有369家公司正设法筹集资金,总额达500亿美元。反观新兴市场,竞争远没有那么激烈。在传统市场中,来自投资者的压力也在增加。考夫曼基金会(Kauffman Foundation)(一个发扬企业家精神的机构)的一份新报告给出了一些负面观点。报告分析了考夫曼基金会的风投组合,并总结出每100家基金有62家的未能提供高于公开市场的收益。

Most venture-capital firms do not head abroad with the sole aim of looking for copycats, but plenty of their investments end up that way. Douglas Leone of Sequoia Capital, a big venture-capital firm, reckons that in emerging markets like China around 50% of start-ups backed by foreign venture capitalists in the internet and mobile sectors are copycats, and in markets like Brazil it is closer to 70%.

大部分风投公司进军国外市场的目的并非只是寻找模仿者,但他们许多的投资活动最终却只做到了这点。大型风投公司红杉资本(Sequoia Capital)的道格拉斯•莱昂内(Douglas Leone)认为,在像中国这样的新兴市场里,由互联网及移动领域的外国风投公司投资的新兴企业中约有50%是模仿者,这一比例在巴西这样的市场里则更接近70%。

That is not so surprising. Backing tested concepts mitigates the risk inherent in start-ups and means companies are likely to grow quickly, because the original firm has already worked out the kinks. Often the originator of the business does not have the expertise to enter new countries quickly, so copycats can get there first.

这一点不足为奇。投资新兴企业本身就有风险,而对采用经过考验的商业模式的新兴企业进行投资能降低这种风险,也意味着企业可能会快速发展,因为原创企业已将那些新奇想法实践过了。而原创企业往往并不擅长迅速打入新国家的市场,所以模仿者便能捷足先登。

They can also gain an edge by tailoring businesses to local habits. Flipkart, an online-commerce site in India founded by two former Amazon employees, has received funding from Tiger Global, a New York-based hedge fund that specialises in this kind of investing, and Accel Partners, a venture-capital firm. Flipkart has taken off in part because credit cards are less common in India and it offers the option of payment on delivery.

模仿者还能根据当地习购物习惯量身打造商业模式以获得优势。由两个前亚马逊(Amazon)员工创立的印度线上购物网站Flipkart已获得老虎环球基金(Tiger Global)和Accel Partners的投资。总部位于纽约的老虎环球基金是专门从事此类投资的对冲基金;Accel Partners是一家风投公司。Flipkart已开始迅速发展,部分原因是在印度信用卡普及率较低而它则提供货到付款服务。

Another example is Trendyol, a Turkish “flash sale” site that mimics Vente-privee.com and Gilt Groupe, which popularised the idea of time-limited online sales of designer clothing. But Trendyol, whose backers include Kleiner Perkins Caufield & Byers, also sells its own mass-market clothing line, with seasonal designs “crowdsourced” from users in Turkey.

另一个案例是土耳其的“限时抢购”网Trendyol,此网站模仿的是Vente-privee.com和吉尔特集团(Gilt Groupe),正是这两家公司令在线限时抢购品牌时装的概念流行起来的。KPCB风投公司是Trendyol的投资者之一。但Trendyol也拥有自己的畅销服装系列,每季都从土耳其用户处“众包”款式。

There are different ways to play the copycat game. Rocket Internet, started by the Samwer brothers—Alexander, Marc and Oliver—in Germany, is a cloning “factory” that copies American and European businesses, hiring entrepreneurs to run them and exporting these start-ups to emerging markets as fast as possible so they are the first entrants. More traditional venture capitalists are setting up offices and selectively backing local entrepreneurs. American venture investors often prefer to bring in a local partner to provide more consistent mentorship to these entrepreneurs and give advice on how to navigate the domestic market.

而模仿商业模式的方法也各不相同。由桑威尔(Samwer)三兄弟——亚历山大(Alexander),马克(Marc)和奥利佛(Oliver)——在德国创立的火箭网(Rocket Internet)是一家模仿欧美商业模式的时装“工厂”,网站雇用企业家负责经营并将这些新兴企业以最快的速度输出到新兴市场,以成为第一批进入者。更多传统的风投公司正在成立事务所并对新兴市场的本土企业家进行选择性投资。而美国的风投公司往往喜欢找一个本土合作伙伴对这些企业家进行更为一致的指导,并就如何驾驭该国的国内市场提供建议。

Such advice can be valuable, given the specific risks of setting up in emerging markets. First, companies can take longer to get off their feet, given grinding local bureaucracy. “An eight-year fund might not be sufficient in Brazil,” says José Luiz Osorio of Jardim Botânico, a Brazilian seed investor. Second, there are cultural barriers: it can be hard to recruit employees to work for an unknown company in exchange for equity, for instance. Third, exiting through large initial public offerings is unlikely in countries like Turkey and Brazil, where IPO activity is muted and investors like to buy well-known firms; that means venture firms are reliant on strategic buyers to gobble up their creations.

鉴于投资新兴市场有特定风险,这些建议也会有价值。首先,因为当地官僚主义之风甚浓,公司要花更多时间才能发展起来。“在巴西交八年的钱可能都不够”,巴西种子投资机构“植物园”的José Luiz Osorio说道。其次是文化上的隔阂:例如,招募员工为一家不知名的公司打工并以公司股份作为报酬,这可能很困难。第三,在土耳其、巴西这些国家,没什么公司会在那里进行首次上市而且投资者喜欢购买知名公司的股票,所以风投公司不可能通过大型的初次上市活动抽身而退;这意味着风投公司得指望目光长远者购买其创立的公司。

Tropicalisation piles on an additional set of risks. Copycats can easily lose share when the original company eventually enters the local market. Sonico, once the Facebook of Latin America, got “pummelled” when Facebook arrived, says Nenad Marovac of DN Capital, which was behind Sonico. And even if they can see off competition, the copycats are unlikely to be mega-blockbusters because, by definition, they are not new. “With innovation you have a global upside, but with copycat innovation you have geographical limits,” says Eric Archer of Monashees Capital, a Brazilian venture firm.

热带化还会带来额外的巨大风险。当原创公司最终要进入当地市场时,模仿者可能会很容易便失去原有市场份额。曾是拉丁美洲的脸谱网的Sonico在脸谱网打入拉丁美洲时被“扁”了一顿, Sonico投资者DN资本(DN Capital)的Nenad Marovac说道。而且即使这些模仿者能在竞争中获胜,它们也不太可能成为雄霸市场的超级巨头,因为严格来讲它们的商业模式并不新。“有所创新就能在全球范围内拥有优势,但模仿别人的创新却有地理局限性,”巴西风投公司Monashees Capital的埃里克•阿彻(Eric Archer)说道。

It will not be long before emerging markets spawn their own innovations that can be trotted out on a global scale. That would be closer to the spirit of venture capital, which is supposed to ferret out and fund new ideas, not imitations. Until then, however, tropicalisation is set to become an ever more popular strategy. Copy that.

很快,新兴市场就会出现大量在全球范围内适用的创新商业模式。那将更切合风投的要义——搜寻新点子并进行投资,而非投资模仿者。但在那之前,热带化定会成为一个越来越普遍的策略。模仿吧!